Pricing is one of the most important business levers impacting your bottom line. A small change in rate on a product or service can have a large effect on profit. It is imperative that your pricing strategy and execution leverages advanced analytics to ensure decisions are constantly optimized.

Now is the time to be making key decisions that will set your company up for success in 2021. Particularly in subscriber-based businesses, misses to Q1 revenue make your annual targets that much harder to make up. The impact you can have on your year-end revenue is the greatest it will be today.

Despite the importance of pricing strategy, many companies still lack the skilled resources and technical capabilities to analyze and measure impactful pricing drivers such as price elasticity, market forces, promotional activity, and managing your customer base. This results in sub-optimal pricing decisions that impact your potential profits and growth. We have outlined the following 3 key steps to consider in your pricing strategy and execution:

1. Align your pricing strategy to your business strategy

✅ Is your organization aligned on its pricing strategy objective?

Pricing decisions will differ depending on what outcome you are optimizing for. Having clear strategic objectives allows for an informed pricing strategy. You company may want to scale and grow market share for the capability to control pricing down the road. Or perhaps you are focused on continually harvesting margins and optimizing decision making toward profits. To capture the best pricing strategy for your company, ensure your pricing team and corporate strategy are aligned.

✅ Do you have a consistent and enforceable pricing process?

Pricing leaders must make hard decisions that sometimes go against marketing and sales. Having sound processes empowers pricing teams with the authority to make the hard decisions. Establishing a standard pricing process combats confusion between sales and marketing teams, creating efficiency for your company. Make sure your pricing leaders are not afraid to make tough decisions regardless of the corporate pressures. Using a data-driven approach to decision making ensures a consistent process.

✅ Do you know the value your products bring to customers?

Pricing should balance the customer’s demand for value and the firm’s need to cover costs and make profits. Customers buy based on the economic value that the price represents, not just the price itself. The goal is to figure out how much your subscriber is willing to pay for your product, so you can maximize revenue by charging each of them exactly based on their willingness to pay.

Key questions to evaluate your pricing strategy:

- Are you pricing based on your company’s stage in its business lifecycle?

- How are day-to-day pricing decisions managed and governed to ensure policy compliance?

- Do you have a well-accepted process to handle special pricing situations or exceptions?

- How much pricing authority is pushed into the sales organization?

- Do your pricing leaders have the authority to overrule business decision makers?

- How do you effectively segment customers and prospects?

- How do you identify value drivers for your products and services?

- What sort of price differentiation do you have on your products and services

- How can you deploy tailored pricing for different channels, locations, and customer segments?

2. Utilize a market-based approach in your pricing execution

A market-based approach requires an understanding of your market position relative to the competition. Internally, you need to understand the market opportunity and penetration rate of your products and services. Externally, third-party data is generally available to help you develop an understanding of how competitors are performing in a particular market. Bringing together internal and external data into a sophisticated pricing model is the foundation for making sound pricing decisions.

✅ Dimensional Elements – Are you evaluating pricing decisions at the lowest dimensional levels?

Each market, segment and channel have their own dynamics that affect price points and demand. For instance, one market may have a competitor with a strong position looking to wage price wars to keep their share and dominance. Another market may have multiple providers with consistent prices that tend to stay higher.

By understanding the firmographic (B2B) or demographic (B2C) attributes of your customers, where your service assets can be offered, and the impact competitors have across your business will give you the dimensional elements needed to build a good pricing strategy.

✅ Pricing Power – How much can you charge?

Pricing power is a function of:

- Competitive market positioning

- Substitute product offerings

- Channel influence

- Value perception by your customers

Each of these areas need to be evaluated across the key dimensions of your business such as segments, geographies, and sales channels.

By exploring price comparisons, competitive responsiveness, and implementing pricing power analysis, you will be able to determine your pricing power in the market.

✅ Pricing Practice – How much should we charge?

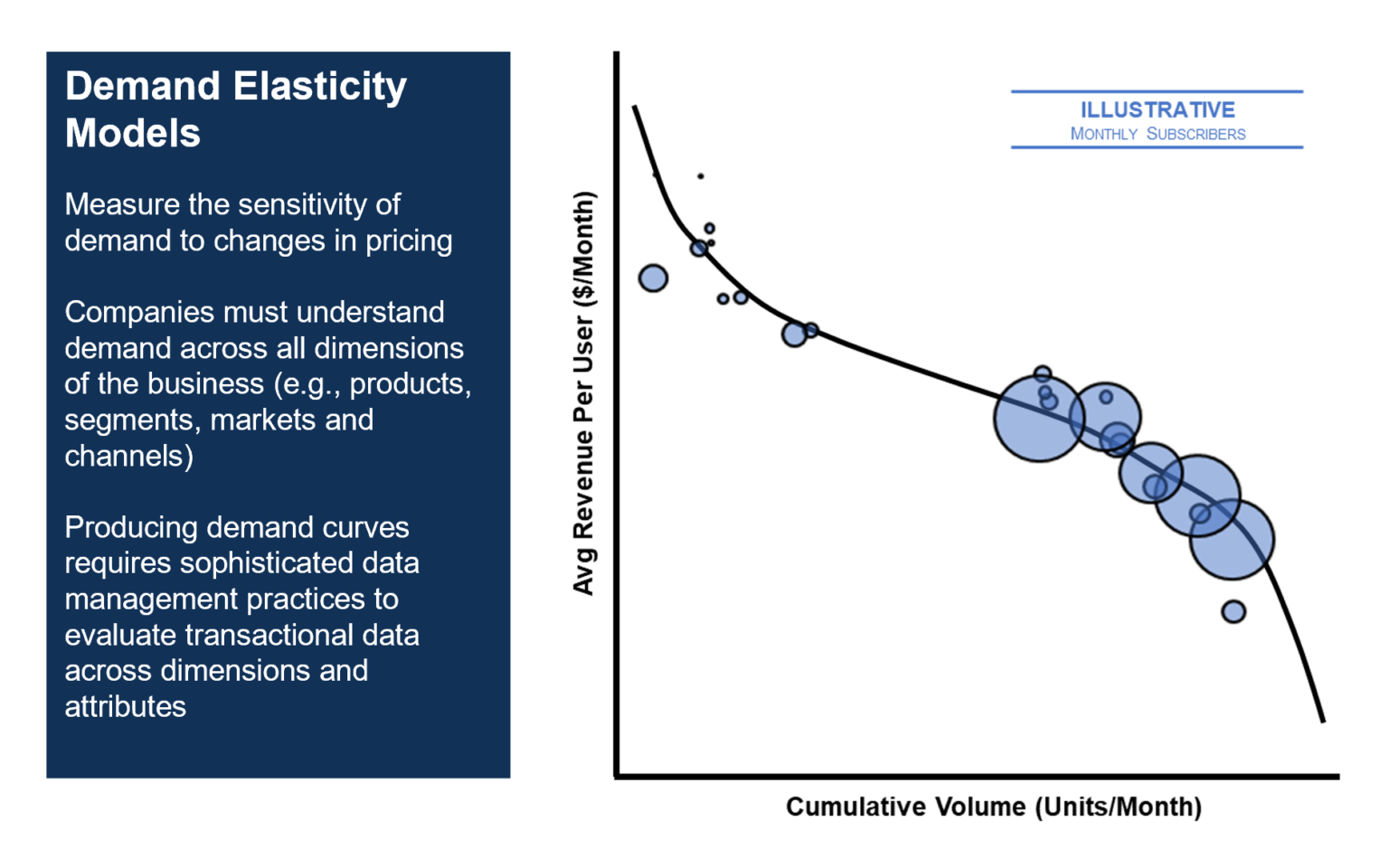

How much you should be charging depends on your pricing strategy objectives. A deep understanding of price elasticity on demand, as well as the effect of raising prices on your base, allows you to effectively determine how much you can charge new and current customers.

A demand model shows mathematically how changes in rate will impact volumes based on historical price points. Demand and revenue curves provide insight into price elasticity across many dimensions and attributes. What makes producing demand models difficult are the temporal pricing factors such as promotional activity, seasonality, and competitive intensity that are continuously changing.

In addition to demand models, you need to evaluate the implied tradeoffs of raising rates on your current customers. Many companies are reluctant to implement across-the-board price increases for fear of brand damage or customer loss. While some customer loss is certain with a price change, the fears are almost always exaggerated. An intelligent pricing model that computes the incremental break-even point can bolster confidence in a price increase decision.

✅ Lifecycle Stage – How does company lifecycle stage affect your pricing strategy?

Pricing strategy differs depending on a company lifecycle stage. New entrants into a market may need to take share to properly scale their business. As companies start to scale, the focus may shift toward renewals and cross-sales opportunities. Companies with a mature customer base may look to harvest and focus on retention.

The stage of your company and your future growth potential will greatly impact your pricing strategy. Ensure that your pricing strategy is aligned with your long-range planning efforts.

Key questions for utilizing a market-based approach:

- Does your company take market dynamics, segmentation, and channel economics into consideration when setting prices?

- Do you know which price plans are generating the most customer lifetime value?

- How is pricing affecting your win rates?

- Are you making pricing decisions looking at the competitive dynamics of each market?

- How will competitors respond to your pricing actions?

- How much can you raise prices before stifling off demand?

- Does your company have demand curves on each product line across geography, channel, and segment?

- What is the estimated market impact on demand and price?

- Are you addressing renewals with the appropriate resource levels?

- Are you evaluating the implied tradeoffs of annual price increases on your customer base?

3. Leverage AI technology for speed and scale

With the advent of the cloud, companies are now well-positioned to scale pricing analysis necessary for making real-time decisions on strategy. Machine learning models allow you to analyze every transaction, ensuring demand curves include near-real time data across all dimensions. There are also supervised learning techniques that can be applied to pricing models to clearly define the factors or drivers of price elasticity.

✅ Can you make data-driven pricing decisions in real-time?

Machine learning is used to continuously identify and detect changes in pricing drivers. While humans can evaluate a few pricing factors at once, machine learning allows you to evaluate all of the factors, providing a complete analysis of the drivers affecting price elasticity. The speed and depth of this analysis allows you to react faster than your competition and ensures your price points are continuously optimized, which translates to your bottom line.

✅ Is your data ecosystem set up to support pricing analysis?

A properly configured data ecosystem is the foundation to setting up a pricing decision support system. Data on market opportunity, competitors, sales opportunities, billing history and product economics may be stored in different sources and platforms. It is imperative that your pricing team can bring together all your data in a structured way.

This requires scalable data management skills to cleanse, standardize and match sources. Machine learning and algorithms can be used to standardize addresses, perform matching of data from different systems, and fill in missing gaps in your data. This will allow you to create a decision support platform ready for pricing decisions.

Key questions for leveraging AI technology:

- Do you currently have the analytic expertise in your pricing staff?

- Are you leveraging modern technology to affordably deliver pricing analysis?

- Is your pricing analysis done at the transactional level and available in near-real time?

- What data, tools and skills are you using in pricing decisions?

- Is your data structured in a way to orchestrate the proper analytics?

- Do you have the right metrics to measure the efficacy of the pricing process?

How Can We Help?

Feel free to check us out and start your free trial at https://app.g2m.ai or contact us below!