A strong revenue model is the backbone of any SaaS company’s growth strategy. It provides clarity on how leads convert into paying customers, how sales trends evolve over time, and what revenue can be expected in the future. Without a well-structured model, businesses risk making decisions based on guesswork rather than data.

This post explores a structured approach to revenue modeling, tracking different stages of the sales funnel, conversion rates, and forecasting sales. Whether you’re a startup refining your go-to-market strategy or a scaling company optimizing your sales process, this guide will help you create a more predictable and scalable revenue engine.

Understanding the Sales Funnel in Revenue Modeling

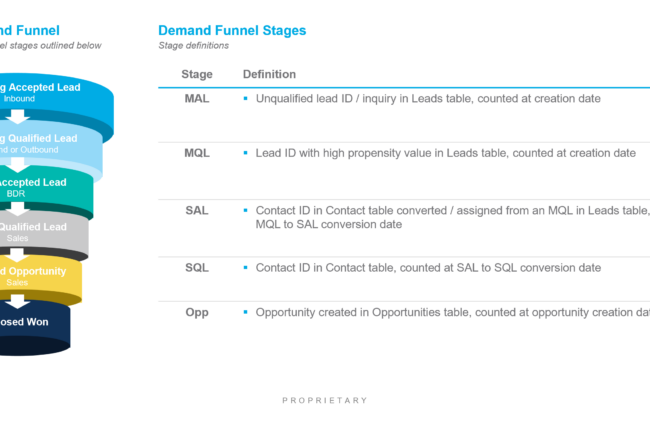

At the core of any revenue model is the sales funnel—a structured process that tracks how leads move from initial interest to becoming paying customers. In a SaaS business, this typically includes:

-

- Lead Generation: Capturing inbound and outbound leads through various channels.

- Marketing Qualified Leads (MQLs): Prospects who have shown engagement and meet initial qualification criteria.

- Sales Qualified Leads (SQLs): MQLs that have been further vetted by the sales team and deemed ready for a sales conversation.

- Opportunities: SQLs that have moved into a formal sales process, including demos, proposals, and negotiations.

- Closed Deals: Successfully converted customers who have signed up for the service.

Tracking the movement of leads through these stages, both in terms of volume and conversion rates, is essential to building a reliable revenue forecast.

Key Components of a SaaS Revenue Model

Key Components of a SaaS Revenue Model

To build a robust revenue model, businesses need to track several key metrics:

Lead Generation & Pre-Opp Stage

Understanding where leads are coming from and their quality helps in making informed marketing investments. This stage involves tracking:

-

- The number of leads generated per channel.

- The conversion rate from lead to MQL.

- The average time a lead takes to move from one stage to another.

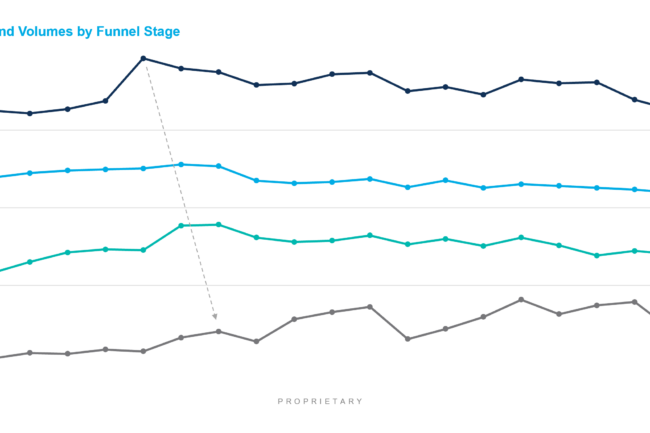

Sales Pipeline Metrics

Once leads enter the sales pipeline, tracking how they progress through various deal stages provides insights into:

-

- Conversion rates at each stage of the funnel.

- The velocity of deals (how quickly they move through the funnel).

- The volume of opportunities required to hit revenue targets.

Conversion Rates & Velocity

One of the most crucial aspects of a revenue model is understanding how effectively leads move through the funnel. By analyzing historical conversion rates, businesses can predict future revenue with greater accuracy.

Revenue Projections

A revenue model estimates the company’s future income based on:

-

- Number of new deals closed per period.

- Average contract value (ACV) and pricing structure.

- Churn rate and customer retention metrics.

- Expansion revenue through upsells and cross-sells.

How a Revenue Model Works

How a Revenue Model Works

A well-structured revenue model enables businesses to compare different scenarios and adjust assumptions based on market conditions. By inputting current pipeline data and historical conversion rates, businesses can:

-

- Forecast revenue on a quarterly and annual basis.

- Assess different growth strategies (e.g., increasing lead volume vs. improving conversion rates).

- Identify bottlenecks in the sales process that need optimization.

Forecasting Sales & Revenue Growth

Revenue forecasting isn’t just about projecting numbers; it’s about making data-driven decisions. A good model allows companies to:

-

- Simulate different revenue outcomes based on varying sales assumptions.

- Understand the impact of marketing spend on lead generation.

- Model customer lifetime value (CLV) and predict long-term growth.

By consistently refining assumptions and incorporating new data, companies can build a more predictable revenue engine.

Common Pitfalls & Best Practices

Even the best revenue models can fall short if they don’t account for real-world challenges. Here are some common pitfalls to avoid:

-

- Overestimating conversion rates: A small error in assumptions can lead to significant discrepancies in revenue forecasts.

- Ignoring seasonality and market shifts: Many industries experience fluctuations in demand; failing to account for this can result in inaccurate predictions.

- Neglecting churn and expansion revenue: Focusing only on new sales without considering customer retention and upsell opportunities can lead to underestimating long-term revenue potential.

Best practices for improving your model include:

-

- Regularly updating conversion rates based on real data.

- Running different scenarios to stress-test assumptions.

- Aligning marketing and sales teams to ensure accurate pipeline tracking.

Conclusion

Revenue modeling is an essential practice for SaaS businesses looking to scale predictably. By tracking the right metrics, analyzing funnel performance, and making data-driven adjustments, companies can optimize their growth strategy and ensure financial stability.

Whether you’re building a revenue model for the first time or refining an existing one, a structured approach will help you make better decisions and drive sustainable growth.

Want to learn more? Explore our resources or connect with us for tailored insights into optimizing your revenue strategy.

How Can We Help?

Feel free to check us out and start your free trial at https://app.g2m.ai or contact us below!